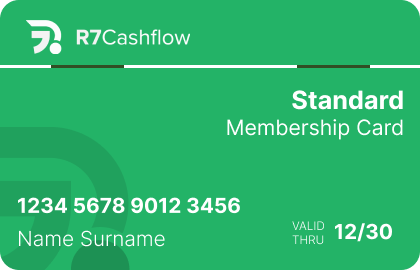

Standard Membership Card

Process Your Personal Loan With Our NBFC Partners With Ease

We understand that it becomes very crucial for an enthusiastic individual like you to avail financial guidance to reach your financial goals in your personal pursuits. By having the same goal in mind of providing superior financial consultation and services, we designed the standard membership card – the most effective and simple medium of processing personal loans with our partnered NBFCs from your fingertips.

Rs. 1499.00 499.00 only

Buy Now

Benefits Of Standard Membership Card

When applying for a loan, you must deal with many complex aspects, including extensive research among financial institutions, understanding their eligibility nuances, filling out tons of paperwork, waiting, and, if rejected, repeating the process until the loan is approved by one institution.

The standard membership card simplifies these time-consuming processes by allowing you to apply for a personal loan from the comfort of your own home via an easy-to-use digital portal. Aside from these, we offer a variety of benefits such as loan applications with multiple NBFCs with no negative impact on your CIBIL score, a completely online process, a dedicated loan expert to walk you through the process with ease, a personalized portal with all the necessary information at your fingertips, on-call expert support, and so on.

How it Works?

1. Easy Registration Process

Begin the application process by simply filling out our registration form with your basic information, such as your name as per your bank records, mobile number, etc.

2. Check Eligibility

After entering loan-related information such as loan purpose, income, etc., our system will check your eligibility and display a pre-approved personal loan offer based on your profile, which is not final approval.

3. Standard Membership Card

To access the displayed pre-approved personal loan offer, purchase our Standard membership card by making a payment that is convenient for you from the various payment options.

4. Upload Documents

You will now have to submit the required documents by logging in with the credentials that are sent to you via registered email.

5. Bank Verification

Now, the NBFC will verify your documents and profile in conformity with their guidelines and rules.

6. Loan Sanction

The NBFC will make the final decision after verifying your profile and will then sanction and disburse the funds.